Home buyers have received a nice boost in purchasing power and affordability recently. With mortgage rates moving down from as high as 5% in November to 4.25% as of this week, this is a gain of 7.5% in purchasing power in just the past few months. This means a buyer who could afford $600,000 in November, can now afford $645,000 with the same mortgage payment. It’s a good time for buyers to get approved for financing again to purchase a home.

Mortgage Rates Drop from 5% to 4.25%

As you can see below, it has been a steady decline in rates since November.

There was a lot of concern that rates when rates hit 5% in November, they were going to continue moving higher. It moved a lot of buyers to the sidelines.

With rates back down to 4.25% on a 30 year fixed, it’s welcome news for buyers who are looking to buy a home in 2019.

Why Mortgage Rates are Moving Lower

Why are rates moving lower? You are going to hear a lot of chatter about “Global Growth Concerns” over the next few months.

Global Growth Concerns include any of the following…trade war re-escalations between the US and China, Brexit negotiations, Italy falling back into recession, Germany soon to be in recession, the US soon to be in recession, corporate earnings deceleration, fear that front-loaded economic activity due to tariff fears would make for a bigger slowdown after the inventory-building.

All of these concerns are causing a “flight to safety” of investor funds from riskier assets like stocks into safer bonds and Treasuries, which in turn is driving down interest rates.

The 10-Year Treasury, which is the best indicator for the direction of longer term interest rates, was as high as 3.25% in November. It has moved down to 2.63% as of this week, see chart below. The 30-year mortgage rate follows the direction of the 10-Year Treasury.

The German Bund 10-Year equivalent is currently trading at “.10”, the Japanese 10-year is trading negative at “-.03”. These are 2 of the top 5 economies in the world, so global concerns are already moving rates in other countries back down to record lows.

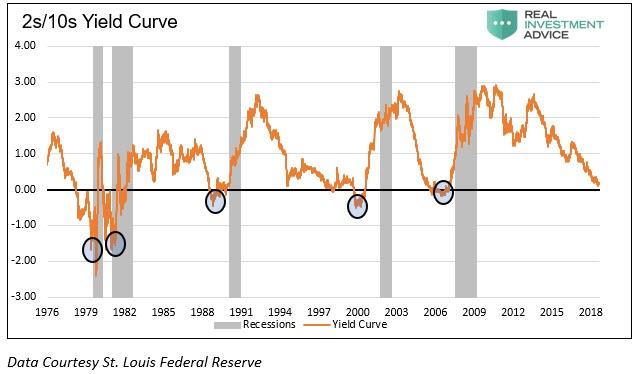

Some people may ask, what indicators are pointing to the the US going into recession soon? The Yield Curve Predictive History is one of them.

The graph below shows that when 2-year Treasury yields exceed 10-year Treasury yields, otherwise known as “a yield curve inversion,” a recession has always followed. Following the inflection point of the inversion, as circled, the curve steepens through a recession and for some time afterward. It looks like the yield curve is on the cusp of inverting soon, which indicates a recession is probably coming to the US in the next 12-18 months.

A combination of some or all of the global growth concerns listed above is going to drive rates lower over the next 6-12 months.

Therefore I believe it is only a matter of time before our 10-Year Treasury continues moving towards 2% and possibly lower, which will drive down the 30-year fixed rate mortgage below 4% sometime in 2019. Watch the direction of the 10-Year Treasury over the next few months.

The Impact of Lower Rates on Purchasing Power

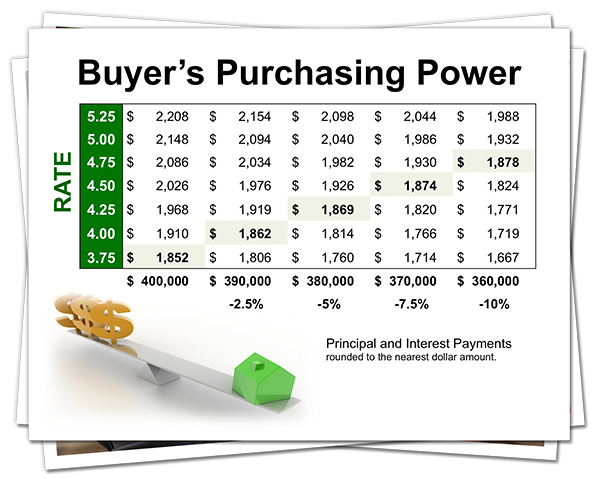

Changing mortgage rates do more to influence home affordability than changing home prices. This chart below shows the “impact of lower rates on buyer purchasing power and affordability“.

When rates decrease by 7.5%, a buyer gains 7.5% in purchasing power. Mortgage rates were as high as 5% in November, so with rates back down to 4.25% again, this means a homebuyer has gained 7.5% in purchasing power in just the past few months.

For example, see how the payment at the 5% rate on a $370k loan, is roughly the same payment as the 4.25% loan at $400k, a gain of 7.5% in purchasing power for a buyer.

This means a buyer who could afford $500k in November, can now afford $537,500 with the same mortgage payment.

Or a buyer who could afford $600k in November, can now afford $645k with the same mortgage payment.

Current mortgage rates compared to the past 40 years

This chart below puts current mortgage rates in perspective. Did you know the average 30 year fixed mortgage rate over the past 40 years is roughly 8.7%, and 6.29% over the past decade.

Compare this to current rates at 4.25%.

If you need to borrow money to to buy a home, these current interest rates are a gift.

It’s a Great Opportunity to Buy a Home

With the recent drop in rates, it’s a great opportunity for buyers to get approved for financing to buy a home. There were plenty of buyers who stopped moving forward with the home buying process towards the end of last year because of rising rates.

With these new lower rates, it’s a a good idea for buyers to get approved again to see how much extra home they can afford, or how much lower the payment is compared to 3 months ago. This will improve their purchasing power and they will probably have more inventory to look at.

If you have questions or you would like to get a free rate quote, just let me know and I can run the numbers for you. I look forward to chatting soon.

P.S. If you would like to be updated faster on important industry news or any new loan programs that come out, please join my Facebook page .