Figures provided by FICO Inc. show that 25% of consumers (about 43 million people) now have a credit score of 599 or below, making them a big risk for lenders. This number is up from the historical norm of 15%. At the other end, interestingly, the number of consumers who have a top score of 800 or above has increased in recent years – mostly attributed to them cutting spending and paying down debt. Here are 5 great strategies below that you can utilize right away to give your score a little boost, as this will ultimately get you a lower interest rate and save more money on any purchases you need to borrow or finance.

Many people had their credit profiles affected by the financial crisis in the US from 2007 to 2010. With mortgages getting tougher to qualify for and underwriting guidelines requiring higher credit scores, understanding how credit scoring works is something that consumers must learn about, so they qualify for financing to purchase a home.

Your Credit Scores and Mortgage Rates

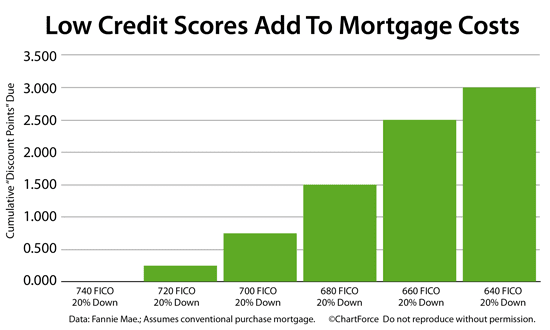

It is no secret that having good credit scores are important for buyers in this market to score the best rates, and this is especially true for conventional rates. For example, check out this chart below, a buyer with a 690 credit score purchasing a $400k home with 20% down, has to pay an additional 1.5 points ($4,800) to get the same rate as a buyer with a 740 score, or if they choose not to pay the points, instead they have to take a .375% higher interest rate (which will incorporate these points).

A buyer with a 660 score, has to pay 2.5 points to get the same rate as a 740 buyer, which amounts to $10k on a $400k loan. So having good scores is important to score the best rates on conventional financing.

To maintain great credit, everyone should review a copy of their credit report once a year, so when you are ready to get financing, this will ensure you are always in a position to score the best rates. As a California resident, you are entitled to a free report once a year.

I have a section on my website devoted to helping consumers and borrowers understand credit scoring, so they can improve their credit scores and get the best interest rates, see HERE to review this section.

5 ways to increase your credit score-and fast

Here are 5 great strategies that you can utilize right away to give your score a little boost..

1. Get Your Report.

The three main credit bureaus, Equifax, Experian®, and TransUnion®, are required by law to provide you with a free copy of your credit report once every 12 months. To request your free copy (one from each company) visit AnnualCreditReport.com or call 1-877-322-8228. (Note: free credit reports do not include credit scores.

Scores can either be purchased on-line or pulled by your mortgage professional.) While you’re on-line, be sure to visit www.optoutprescreen.com as well. This will help you “opt out” of all the junk mail you get in the mail, credit experts advise this will give your score a boost immediately.

2. Create Some Balance:

The trick is to get and keep your balances below 30% of your credit limit on each card. Remember, if you pay off any credit cards completely, do not close your accounts without discussing it with your mortgage professional first. Canceling those cards may inadvertently undo all of your hard work.

3. Know your limits:

Make sure that your credit card issuers are reporting the correct limits on your accounts to the three major credit bureaus. Without an available limit, your account will appear to be maxed out at its highest reported balance each month. This could cost you up to 80 points in certain instances.

Also, if you’re in very good standing, ask your creditor for a lower rate or higher credit limit. This will increase the gap in the debt you owe versus the credit you have available. Sometimes hinting about closing an account can suddenly bring out the generous spirit of certain card issuers. Give it a try. The worst they can say is no.

4. Protect Your Interests:

Your credit is calculated based solely on the information available to your creditors. If you have a HELOC, make sure it’s listed as a mortgage or an installment account on your credit reports and not a revolving debt. If you had a bankruptcy, be sure that all items associated with the bankruptcy are being reported correctly, that is with a zero balance. This action could increase your score by 50-100 points. Because simple mistakes like these can wreak havoc on your credit score, it’s important to monitor your credit every four to six months.

5. Even the Score:

If you find information on your credit report that you believe is inaccurate or incomplete, then you have the right to dispute it free of charge. For the fastest results, visit the appropriate credit bureau’s website and file a complaint on-line. If supporting documents are necessary, you have to file your dispute by mail.

Educating consumers about credit scoring

As you can see above, a small increase in credit scores from 700 to 740 can save someone $4,500k on a $300k purchase loan and get them a lower rate. I think it is important that consumers understand and learn about credit, so they have the opportunity to score the lowest rates when they are looking to borrow money and finance purchases.

One of the tools we can use is the “credit analyzer” system which our credit company offers for our clients, this predictive credit scoring system will allow you to see how high credit scores can go if certain actions are taken in regards to credit, so this way a potential buyer has a definite plan of action to improve their credit scores to meet the qualifications needed for a loan. The credit analyzer truly is a fantastic tool as it accurately predicts future credit scores using the same algorithms used in credit scoring.

If you know of anyone that needs a little help improving their credit scores so they can qualify for a loan or they need help getting pointed in the right direction to repair their credit, feel free to contact me at 858-442-2686 with any questions you have. I look forward to chatting soon.